cares act illinois student loans

The portal is open from September 29 2020 through noon on Saturday October 31 2020. Pritzker announced a plan to provide relief for student loan borrowers who were left out of the federal relief plan through the CARES Act.

6 Best Student Loans Of May 2022 Money

Students with federal student loans.

. CARES Act Emergency Relief. Department of Education eligible student loans for a period of at least 60 days was previously announced by executive order on March 13 2020. In addition to federal relief funding Illinois State is providing emergency financial assistance to students through the COVID-19 Redbirds.

Biden Cancelled 15 Billion Of Student Debt For Borrowers But You Can Still Apply Now. The CARES Act did nothing to change your Private Loans. They can communicate the act to ensure all employees are aware of these provisions so that those who need them can take full advantage.

In total Illinois State is set to receive 161 million through the CARES Act. The CARES Act is a 22 trillion stimulus package passed in March 2020 to. The CARES Act gives employers a number of ways to use their education assistance programs to support their people.

CARES Act Student Loan Forgiveness. Illinois transit agencies will receive an estimated 16 billion in federal. It has been crucial as unemployment numbers have risen to staggering heights as a result of.

Coronavirus COVID-19 CARES Act Student Loan Fact Sheet Payments automatically deferred and interest is waived on federally held student loans through Sept. This includes Direct Stafford Loans Direct PLUS Loans for parents and graduate students and Direct Consolidation Loans. HFS will consider the amount of COVID-related funding providers are receiving.

It enables employers to maximize existing student loan repayment programs while also offering. Under the new law no payments are required on federal student loans owned by the US. The Coronavirus Aid Relief and Economic Security CARES Act provides additional flexibility for student loan borrowers during the Coronavirus Outbreak including automatically suspending.

Cares act illinois student loans Monday January 10 2022 Edit. As stipulated in the act 8 million of that money is designated for emergency financial aid given directly to students. The Coronavirus Aid Relief and Economic Security Act or CARES Act was passed by Congress on March 27th 2020.

Suspends student loan monthly payments for 6 months. HFS will make final funding and policy decisions based on federal and state laws regulations and guidance. This forbearance period allowed federal student loan borrowers to suspend loan payments and set interest rates to zero percent Student Aid.

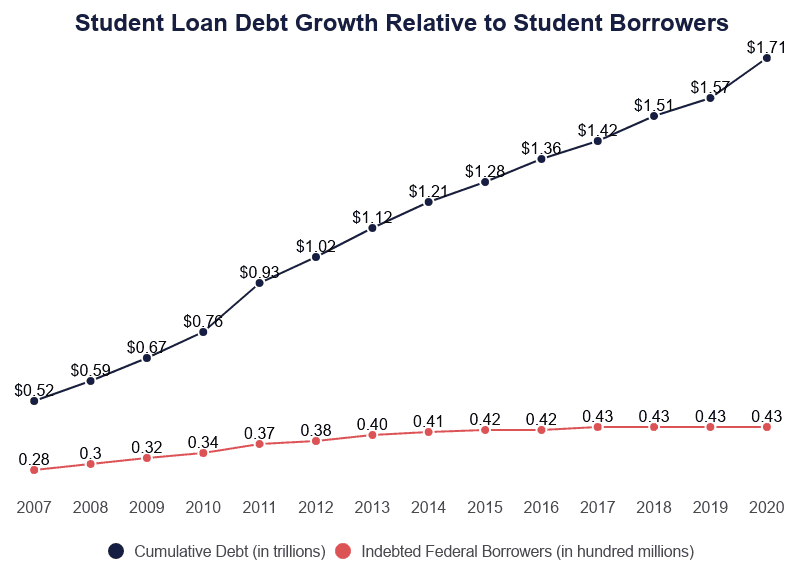

A federal stimulus bill to address the impact of the Coronavirus was passed by Congress and signed into law on March 27 2020. In addition the interest on these federal student loans will automatically drop. In the United States more than 44 million borrowers in the United States carry student loan debt totaling nearly 16 trillion.

Interest will most likely continue to accrue it depends on your servicer but a forbearance. Department of Education are covered under the CARES Act. Covers approximately 95 of borrowers excludes federal debt held by private companies Federal Family Education Loan program and federal debt held by colleges and universities.

If you have private loans requesting a forbearance might be your best way forward. However many of the Private Student loans servicers have their own programs to help in times of uncertainty. Pritzker said this newly approved.

Additionally to take advantage of the two-month suspension period that the executive order offered a student borrower must have opted-in by contacting their federal loan servicer. If you are currently paying federally held student loans the CARES Act may provide you some relief during the COVID-19 public health crisis including automatically suspending payments and the institution of 0 interest rates. The Federal Student Loan forbearance period that was implemented on March 27 2020 as part of the Coronavirus Aid Relief and Economic Security CARES Act is set to cease on January 31st 2021.

Pritzker said Tuesday that relief is coming for Illinois residents paying private and non-federal student loans who are not covered by the CARES Act. For complete information about the CARES Act and student loans go to wwwstudentaidgovcoronavirus. The CARES Act didnt include a provision to forgive student loan debt but since payments have been frozen thousands of borrowers have had their federal loans eliminated under existing programs the White House has tried to fix.

Relief for borrowers of student loans owned by the US. The new initiative applies to borrowers who were not provided relief under the federal Coronavirus Aid Relief and Economic Security Act or CARES Act which was signed by President Donald Trump March 27 and assisted Americans with federal student loans by delaying repayments until Sept. The CARES Act the sweeping stimulus legislation enacted in March includes relief for student loan borrowers.

Section 18004c of the CARES Act requires the recipient institution to use no less than 50 percent of the funds received to provide emergency financial aid grants to students for expenses related to the disruption of campus operations due to the coronavirus including eligible expenses under a students cost of attendance such as food housing course materials technology. Federal student loans that are owned by the US. Department of Education between March 13 2020 and August 31 2022.

Allocates 25 billion in federal transit formula funding to keep public transit operating throughout Illinois in order to ensure continued access to jobs medical treatment food and other essential services. In the meantime isac and the state of illinois have worked to mitigate hardships for student borrowers with other federal loans not covered by the cares act. Education Stabilization Fund Transparency Portal March 17 2021 Covid-Relief-Dataedgov is dedicated to collecting and disseminating data and information about the three primary ESF programs that the Coronavirus Aid Relief and Economic Security CARES Act authorized and the Department manages.

The CARES portal can be found at httpscaresapphfsillinoisgov. The CARES Act continues to help borrowers avoid missing payments or defaulting on student loans. Of that money approximately 14 billion was given to the Office of Postsecondary Education.

CARES Act Student Loan Borrower Protections. Interest rates are at 0 on government-held federal student loans until at least September and borrowers. Student Loan Debt.

Under the CARES Act you will not need to opt-in to take advantage of the six-month suspension. The cares act provides assistance to most federal student loan borrowers and if you have this type of debt heres what the new law can do for you. Student Loan Scams 3 Warning Signs To Watch For Money Tell The Department Of Education To Fix Public Service Loan Forgiveness And Deliver On The Promise Of Debt Relief For The Legal Services Community Student Loan Borrowers Assistance.

Federal income taxes on the payments. The Student Investment Account Act 110 ILCS 991 permits the Office of the Illinois State Treasurer Treasurer to establish the Student Investment Account which will invest up to five percent 5 of the State Investment portfolio on a continuing and recurring basis approximately 800 million as of January 2021 in affordable and responsible education loan products. The CARES Act overrides the Presidents previous executive order.

This bill allotted 22 trillion to provide fast and direct economic aid to the American people negatively impacted by the COVID-19 pandemic.

What To Know About The Debate Over Student Loan Forgiveness Npr

Student Loan Forgiveness Programs The Complete List 2022 Update

Student Loan Forgiveness Programs Credible

Student Loan Requirements How To Qualify For A Student Loan

Many Student Loan Borrowers Missed A Chance To Exit Default Money

The Full List Of Student Loan Forgiveness Programs By State

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Current Student Loans News For The Week Of Jan 17 2022 Bankrate

Student Loan Forgiveness Could Help 1 4 Million In Michigan What To Know Bridge Michigan

How To Get A Student Loan Money

Student Loan Requirements How To Qualify For A Student Loan

Make Student Loan Debt Dischargeable In Bankruptcy Again

Student Loan Debt Statistics In 2022 A Record 1 7 Trillion

:max_bytes(150000):strip_icc()/GettyImages-469187462-567c718d5f9b586a9e9dafaf-5c112b82c9e77c00012cb9bd.jpg)

How To Get Covid 19 Student Loan Relief

Student Loan Debt Crisis In America By The Numbers Educationdata Org

Student Loan Scams 3 Warning Signs To Watch For Money

The Cares Act And Student Loans A Guide I Morgan Stanley At Work

More Companies Are Wooing Workers By Paying Off Student Debt Money